[ Today @ 12:10 AM ]: Local 12 WKRC Cincinnati

[ Yesterday Evening ]: Fortune

[ Yesterday Evening ]: WGME

[ Yesterday Evening ]: Investopedia

[ Yesterday Afternoon ]: al.com

[ Yesterday Afternoon ]: Fox 23

[ Yesterday Afternoon ]: HousingWire

[ Yesterday Afternoon ]: HousingWire

[ Yesterday Afternoon ]: Reason.com

[ Yesterday Afternoon ]: Investopedia

[ Yesterday Afternoon ]: Southwest Times Record

[ Yesterday Afternoon ]: WSB-TV

[ Yesterday Afternoon ]: The Daily Advertiser

[ Yesterday Morning ]: Wall Street Journal

[ Yesterday Morning ]: BBC

[ Yesterday Morning ]: FOX 5 Atlanta

[ Yesterday Morning ]: fingerlakes1

[ Yesterday Morning ]: BBC

[ Yesterday Morning ]: Milwaukee Journal Sentinel

[ Yesterday Morning ]: Cleveland.com

[ Yesterday Morning ]: CNET

[ Yesterday Morning ]: CNET

[ Yesterday Morning ]: reuters.com

[ Yesterday Morning ]: Fortune

[ Yesterday Morning ]: Fortune

[ Yesterday Morning ]: CBS News

[ Last Monday ]: InStyle

[ Last Monday ]: WGME

[ Last Monday ]: Local 12 WKRC Cincinnati

[ Last Monday ]: Seeking Alpha

[ Last Monday ]: Fox 11 News

[ Last Monday ]: HuffPost

[ Last Monday ]: Journal Star

[ Last Monday ]: London Evening Standard

[ Last Monday ]: Investopedia

[ Last Monday ]: Fortune

[ Last Monday ]: Military Times

[ Last Monday ]: Forbes

[ Last Monday ]: ABC Kcrg 9

[ Last Monday ]: Lincoln Journal Star

[ Last Monday ]: fingerlakes1

[ Last Monday ]: Wall Street Journal

[ Last Monday ]: BBC

[ Last Monday ]: WSMV

[ Last Monday ]: BBC

[ Last Monday ]: The Courier-Journal

[ Last Monday ]: London Evening Standard

[ Last Monday ]: Fortune

[ Last Monday ]: CNET

[ Last Monday ]: Fortune

[ Last Monday ]: NOLA.com

[ Last Sunday ]: deseret

[ Last Sunday ]: CNN

[ Last Sunday ]: Fortune

[ Last Sunday ]: Longview News-Journal

[ Last Sunday ]: The Citizen

[ Last Sunday ]: WTOP News

[ Last Sunday ]: news4sanantonio

[ Last Sunday ]: CBS 58 News

[ Last Sunday ]: BBC

[ Last Sunday ]: 14 NEWS

[ Last Sunday ]: Fox News

[ Last Sunday ]: The Scotsman

[ Last Sunday ]: The Globe and Mail

[ Last Sunday ]: reuters.com

[ Last Sunday ]: BBC

[ Last Sunday ]: Hackaday

[ Last Sunday ]: Impacts

[ Last Sunday ]: Wall Street Journal

[ Last Sunday ]: Action News Jax

[ Last Sunday ]: Newsweek

[ Last Saturday ]: deseret

[ Last Saturday ]: HousingWire

[ Last Saturday ]: WLAX La Crosse

[ Last Saturday ]: CBS News

[ Last Saturday ]: Realtor.com

[ Last Saturday ]: WFXR Roanoke

[ Last Saturday ]: Investopedia

[ Last Saturday ]: OPB

[ Last Saturday ]: Daily Record

[ Last Saturday ]: fingerlakes1

[ Last Saturday ]: BBC

[ Last Friday ]: Newsweek

[ Last Friday ]: The Independent

[ Last Friday ]: Missoulian

[ Last Friday ]: Fox 11 News

[ Last Friday ]: HousingWire

[ Last Friday ]: Investopedia

[ Last Friday ]: Auburn Citizen

[ Last Friday ]: wjla

[ Last Friday ]: Investopedia

[ Last Friday ]: nbcnews.com

[ Last Friday ]: CNN

[ Last Friday ]: Wall Street Journal

[ Last Friday ]: fingerlakes1

[ Last Friday ]: CNET

[ Last Friday ]: CNET

[ Last Friday ]: Fortune

[ Last Friday ]: Fortune

[ Last Friday ]: rnz

[ Last Friday ]: WPTV-TV

[ Last Thursday ]: London Evening Standard

[ Last Thursday ]: HousingWire

[ Last Thursday ]: HousingWire

[ Last Thursday ]: The Motley Fool

[ Last Thursday ]: Realtor.com

[ Last Thursday ]: Forbes

[ Last Thursday ]: fingerlakes1

[ Last Thursday ]: HousingWire

[ Last Thursday ]: The News-Herald

[ Last Thursday ]: Fox 11 News

[ Last Thursday ]: Forbes

[ Last Thursday ]: Investopedia

[ Last Thursday ]: CNET

[ Last Thursday ]: Seeking Alpha

[ Last Thursday ]: The Hill

[ Last Thursday ]: Fox News

[ Last Thursday ]: Wall Street Journal

[ Last Thursday ]: Forbes

[ Last Thursday ]: RTE Online

[ Last Thursday ]: ABC7 San Francisco

[ Last Thursday ]: Newsweek

[ Last Thursday ]: fingerlakes1

[ Last Thursday ]: CNET

[ Last Thursday ]: CNET

[ Last Thursday ]: Fortune

[ Last Thursday ]: Fortune

[ Last Thursday ]: yahoo.com

[ Last Thursday ]: HELLO! Magazine

[ Last Thursday ]: Seattle Times

[ Last Wednesday ]: nbcnews.com

[ Last Wednesday ]: WJHL Tri-Cities

[ Last Wednesday ]: KUTV

[ Last Wednesday ]: ABC

[ Last Wednesday ]: WSB-TV

[ Last Wednesday ]: KKTV11

[ Last Wednesday ]: The Independent

[ Last Wednesday ]: CBS News

[ Last Wednesday ]: wjla

[ Last Wednesday ]: HousingWire

[ Last Wednesday ]: KUTV

[ Last Wednesday ]: news4sanantonio

[ Last Wednesday ]: HousingWire

[ Last Wednesday ]: CBS News

[ Last Wednesday ]: ABC

[ Last Wednesday ]: WNYT NewsChannel 13

[ Last Wednesday ]: BBC

[ Last Wednesday ]: CNBC

[ Last Wednesday ]: NBC New York

[ Last Wednesday ]: Investopedia

[ Last Wednesday ]: news4sanantonio

[ Last Wednesday ]: KOB 4

[ Last Wednesday ]: KOB 4

[ Last Wednesday ]: Realtor.com

[ Last Wednesday ]: fingerlakes1

[ Last Wednesday ]: Global News

[ Last Wednesday ]: Wall Street Journal

[ Last Wednesday ]: Fox News

[ Wed, Jul 23rd ]: Forbes

[ Wed, Jul 23rd ]: The West Australian

[ Wed, Jul 23rd ]: Realtor.com

[ Wed, Jul 23rd ]: KHQ

[ Wed, Jul 23rd ]: abc7NY

[ Wed, Jul 23rd ]: London Evening Standard

[ Wed, Jul 23rd ]: Newsweek

[ Wed, Jul 23rd ]: The Irish News

[ Wed, Jul 23rd ]: The New York Times

[ Wed, Jul 23rd ]: CNET

[ Wed, Jul 23rd ]: CNET

[ Wed, Jul 23rd ]: Fortune

[ Wed, Jul 23rd ]: BBC

[ Wed, Jul 23rd ]: nbcnews.com

[ Wed, Jul 23rd ]: Fortune

[ Wed, Jul 23rd ]: Seeking Alpha

[ Tue, Jul 22nd ]: CBS News

[ Tue, Jul 22nd ]: wtvr

[ Tue, Jul 22nd ]: Deseret News

[ Tue, Jul 22nd ]: news4sanantonio

[ Tue, Jul 22nd ]: WDBJ

[ Tue, Jul 22nd ]: CNN

[ Tue, Jul 22nd ]: London Evening Standard

[ Tue, Jul 22nd ]: the-sun.com

[ Tue, Jul 22nd ]: Local 12 WKRC Cincinnati

[ Tue, Jul 22nd ]: WWLP Springfield

[ Tue, Jul 22nd ]: Fox News

[ Tue, Jul 22nd ]: Investopedia

[ Tue, Jul 22nd ]: BBC

[ Tue, Jul 22nd ]: News 8000

[ Tue, Jul 22nd ]: Denver Gazette

[ Tue, Jul 22nd ]: nbcnews.com

[ Tue, Jul 22nd ]: ABC

Annual home-price growth hit lowest level in two years in May

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

Home prices rose 2.3% on an annual basis in May, down from 2.7% in April, according to the Case Shiller Home Price Index

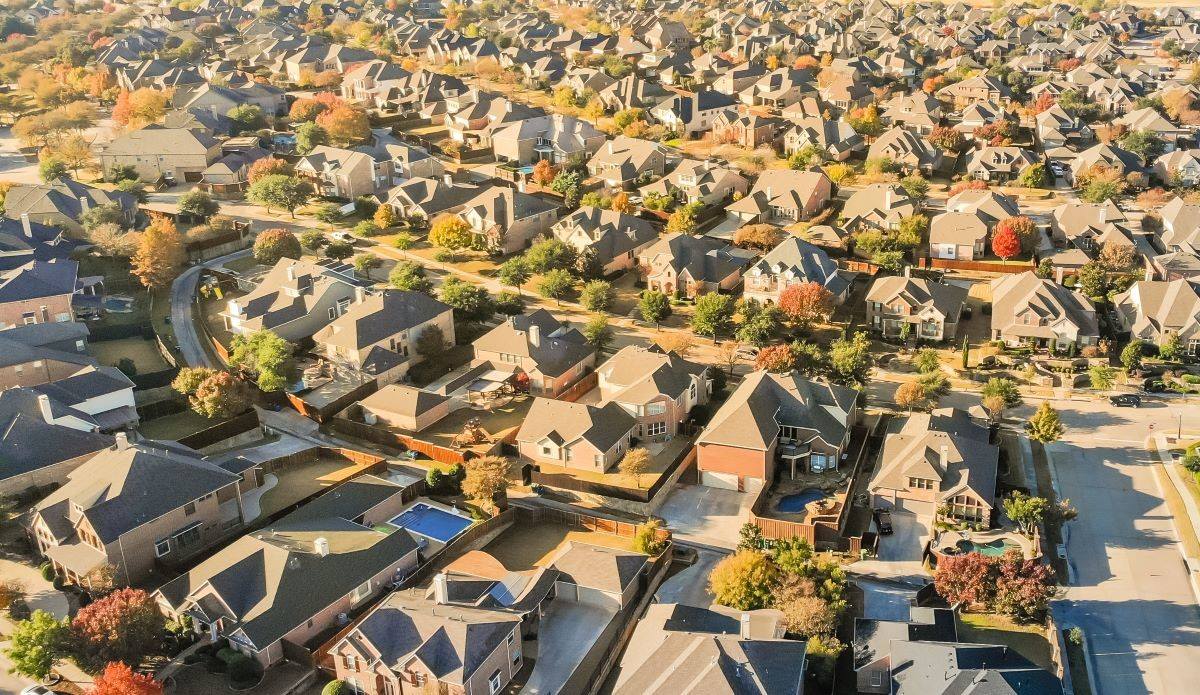

Annual Home Price Growth Slows to Lowest Level in Two Years Amid Cooling Housing Market

In a clear sign of shifting dynamics in the U.S. housing market, annual home price growth has decelerated to its slowest pace in over two years, according to the latest data released by CoreLogic. The report, focusing on May figures, highlights a national year-over-year increase of just 2.9%, marking the lowest growth rate since early 2021. This slowdown comes as high mortgage rates, persistent inflation, and economic uncertainties continue to weigh on buyer demand, potentially signaling a broader cooling trend that could reshape the real estate landscape for homeowners, buyers, and investors alike.

The CoreLogic Home Price Index (HPI), a widely respected gauge of residential property values, underscores this moderation. For single-family homes, prices rose by 2.9% annually in May, a significant drop from the double-digit surges seen during the height of the pandemic-fueled housing boom. On a month-over-month basis, prices edged up by a modest 0.9%, indicating a stabilization rather than the rapid escalations that characterized previous years. This data paints a picture of a market transitioning from overheated conditions to something more balanced, though not without challenges for various stakeholders.

Delving deeper into the regional variations, the report reveals a patchwork of performance across the country. States like Florida and South Carolina led with the strongest annual gains, posting increases of 6.8% and 6.3%, respectively. These Sun Belt hotspots continue to attract retirees, remote workers, and those seeking warmer climates, buoyed by relatively affordable housing compared to coastal metros. In contrast, Western states such as Idaho and Utah experienced outright declines, with prices falling by 2.7% and 1.9% year-over-year. This divergence reflects broader migration patterns and economic factors, including tech sector layoffs in the West that have dampened demand.

CoreLogic's chief economist, Selma Hepp, provided insightful commentary on these trends, noting that the slowdown is largely driven by elevated borrowing costs. "With mortgage rates hovering near 7%, affordability remains a major hurdle for many prospective buyers," Hepp explained. "This has led to a pullback in home sales, which in turn is tempering price appreciation." Indeed, the Federal Reserve's aggressive interest rate hikes aimed at combating inflation have pushed 30-year fixed mortgage rates to levels not seen in over a decade, sidelining first-time buyers and reducing overall transaction volumes.

Looking ahead, CoreLogic's HPI Forecast projects that home price growth will continue to moderate, with an expected annual increase of just 2.7% by May 2024. This forecast assumes a continuation of current economic conditions, including steady but not aggressive rate cuts from the Fed. However, Hepp cautioned that external factors such as labor market strength and inventory levels could alter this trajectory. "If we see a resurgence in homebuilding or a softening in rates, we might witness a rebound in prices," she added. Conversely, a deeper economic slowdown could push prices into negative territory in more vulnerable markets.

This cooling trend is not isolated to home prices; it's intertwined with broader housing market indicators. For instance, existing-home sales have plummeted to multi-year lows, as reported by the National Association of Realtors, with inventory remaining stubbornly low due to the "lock-in effect." Homeowners who secured ultra-low mortgage rates during the pandemic are reluctant to sell and face higher rates on a new purchase, exacerbating supply shortages. This dynamic has created a bifurcated market: while prices are softening overall, competition remains fierce in desirable areas with limited listings, often leading to bidding wars and above-asking sales.

From a buyer’s perspective, this slowdown could present opportunities. Aspiring homeowners who were priced out during the boom years might find more negotiating power as sellers adjust expectations. Real estate agents are already reporting longer days on market and price reductions in previously hot suburbs. For sellers, however, the news is mixed. Those in high-growth regions like the Southeast may still command premiums, but in cooling markets, holding off on listing could be advisable until conditions improve.

Investors and economists are closely monitoring these developments for signs of a potential recessionary impact on housing. Historically, the real estate sector has been a bellwether for economic health, and a prolonged slowdown could ripple through related industries like construction, home improvement, and financial services. The CoreLogic report also touches on the role of natural disasters and climate risks in influencing prices. Areas prone to hurricanes or wildfires, such as parts of Florida and California, are seeing insurance costs soar, which could further depress values in the long term.

To contextualize this data, it's worth recalling the frenzied market of 2021 and 2022, when home prices skyrocketed by over 20% annually in some months, driven by low rates, stimulus checks, and a surge in remote work. That era of rapid appreciation led to concerns about housing bubbles and affordability crises, particularly in urban centers like New York and San Francisco. Now, with growth tapering to under 3%, the market appears to be correcting itself, albeit gradually.

Experts emphasize that this is not a crash but a normalization. "We're moving toward a more sustainable pace of growth," said Mark Fleming, chief economist at First American. "The days of explosive price hikes are behind us, but that doesn't mean the market is collapsing." Fleming points to underlying fundamentals like population growth and household formation as supportive factors that should prevent a steep downturn.

For policymakers, this data underscores the need for targeted interventions to boost affordability. Initiatives such as expanding affordable housing programs, reforming zoning laws to increase supply, and providing down payment assistance could help mitigate the slowdown's effects on lower-income buyers. The Biden administration has already proposed measures to address housing shortages, though progress has been slow amid partisan divides.

In metropolitan areas, the trends are equally telling. Detroit, for example, topped the list for monthly price gains at 1.8%, reflecting its ongoing revitalization and influx of young professionals. Meanwhile, cities like Seattle and Las Vegas saw minimal growth or slight declines, hit hard by tech layoffs and tourism fluctuations. These urban insights highlight how local economies influence national trends, with manufacturing hubs faring better than tech-dependent ones in the current climate.

As we look toward the second half of the year, several wild cards could influence home prices. The upcoming election cycle might introduce policy changes affecting taxes, regulations, and incentives for homeownership. Additionally, global events such as geopolitical tensions or supply chain disruptions could impact building costs and, by extension, new home prices.

In summary, the May home price data from CoreLogic signals a pivotal moment for the U.S. housing market. With annual growth at its lowest in two years, the era of unchecked appreciation seems to be waning, replaced by a more tempered environment shaped by high rates and cautious buyers. While challenges persist, particularly in affordability and supply, this slowdown could foster a healthier, more accessible market in the long run. Stakeholders from all sides—buyers, sellers, investors, and policymakers—will need to adapt to these evolving conditions to navigate what lies ahead. As the market continues to adjust, ongoing monitoring of economic indicators will be crucial to understanding whether this is a temporary dip or the start of a new normal. (Word count: 1,048)

Read the Full HousingWire Article at:

[ https://www.housingwire.com/articles/annual-home-price-growth-hit-lowest-level-in-two-years-in-may/ ]

Similar House and Home Publications

[ Last Monday ]: Fortune

[ Last Sunday ]: Newsweek

[ Last Saturday ]: HousingWire

[ Last Friday ]: nbcnews.com

[ Last Thursday ]: Fox 11 News

[ Last Thursday ]: Seeking Alpha

[ Last Wednesday ]: The Independent

[ Wed, Jul 23rd ]: Newsweek

[ Tue, Jul 22nd ]: The Spokesman-Review

[ Mon, Jul 21st ]: Newsweek