New York's Homeownership Rate: Lowest in the US

Locale: New York, UNITED STATES

The Empire State's Ownership Problem: Why New York Has the Lowest Homeownership Rate in America

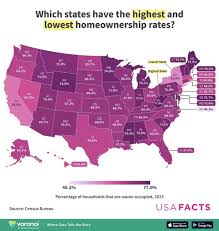

New York has long been a symbol of opportunity and aspiration, but a new reality is emerging: it also holds the dubious distinction of having the lowest homeownership rate in the United States. A recent report highlights this stark statistic – just 54.6% of New Yorkers own their homes, significantly below the national average of roughly 65%. This isn’t a sudden development; the trend has been building for years and reflects a complex interplay of economic factors, demographic shifts, and policy choices unique to the state.

The New York Post article, published January 5th, 2024, dives into this issue, analyzing the root causes and potential consequences of this low ownership rate. The data, drawn from U.S. Census Bureau figures, paints a clear picture: New York’s homeownership rate lags far behind states like Mississippi (over 73%), West Virginia (over 70%), and even neighboring Connecticut (around 69%). This isn't just about individual disappointment; it has wider implications for economic stability, community wealth building, and overall societal well-being.

The Price is the Problem: A Cost of Living Crisis

The primary culprit, as with many affordability challenges nationwide, is the exorbitant cost of housing in New York. New York City, naturally, exerts a significant drag on the state’s overall numbers due to its notoriously high prices. However, even outside of NYC, areas like Long Island and Westchester County are among the most expensive places to buy property in the country. The median home price across New York State is significantly higher than the national median, making it simply unattainable for a large portion of potential buyers.

The article points out that wages haven't kept pace with this dramatic increase in housing costs. While salaries have risen modestly over time, they’ve failed to offset the relentless climb of property values and associated expenses like taxes and insurance. This creates an insurmountable barrier for many, particularly younger generations burdened by student loan debt and facing a competitive job market.

Demographics & Lifestyle Choices Complicate the Picture

While cost is paramount, demographic factors also play a role. New York attracts a significant number of young professionals and transient residents who are less likely to be interested in homeownership. Many prioritize renting for flexibility – allowing them to easily move for career opportunities or explore different neighborhoods. This aligns with broader trends; younger generations, particularly Millennials and Gen Z, have shown a greater willingness to rent compared to previous generations.

The article also notes that New York’s dense urban environments cater well to renters. The abundance of apartment options, coupled with the convenience of city living (public transportation, walkability, cultural amenities), diminishes the perceived need for homeownership. For many, owning a home feels like an unnecessary burden when they can enjoy a vibrant and convenient lifestyle through renting.

Policy & Regulation: Adding to the Burden?

Beyond cost and demographics, New York’s regulatory environment has been criticized for hindering housing supply and driving up prices. Zoning laws often restrict density, limiting the construction of new homes and perpetuating scarcity. The article implicitly suggests that easing these regulations – allowing for more multi-family dwellings and higher-density development – could help alleviate the affordability crisis.

Furthermore, high property taxes are a significant deterrent to homeownership in New York. These taxes contribute substantially to the overall cost of owning a home, making it even less accessible to potential buyers. While property tax reform is frequently debated, meaningful change has been slow to materialize. The article highlights how these taxes disproportionately impact lower and middle-income families striving for homeownership.

Consequences & Potential Solutions

The low homeownership rate isn’t just a statistic; it carries real-world consequences. Lower rates of homeownership are often associated with reduced wealth accumulation, less community investment, and increased social instability. Homeownership is historically a key driver of generational wealth transfer, and its absence can exacerbate existing inequalities.

The New York Post article doesn't offer definitive solutions but suggests several avenues for exploration. These include:

- Zoning Reform: Relaxing restrictive zoning laws to allow for more housing construction.

- Property Tax Relief: Implementing measures to reduce the burden of property taxes on homeowners and prospective buyers.

- Incentivizing First-Time Homebuyers: Offering financial assistance programs, such as down payment grants or tax credits, specifically targeted at first-time homebuyers.

- Increasing Housing Supply: Promoting initiatives that encourage the development of affordable housing options.

Ultimately, addressing New York’s low homeownership rate requires a multifaceted approach that tackles both supply and demand challenges. The state faces a significant hurdle in balancing its desire for economic growth and vibrant urban centers with the need to ensure that homeownership remains an attainable goal for all residents. The current trajectory suggests that without meaningful intervention, the gap between renters and owners will continue to widen, further solidifying New York’s position as the least-owned state in the nation.

Read the Full New York Post Article at:

[ https://nypost.com/2026/01/05/real-estate/new-york-has-the-lowest-homeownership-rate-in-the-us/ ]