US housing construction is dead with current mortgage rates

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

U.S. Housing Construction Plunges as Mortgage Rates Surge

In the wake of a sustained spike in mortgage rates, the U.S. housing market is confronting a crisis of construction that some experts are calling the “construction death spiral.” A recent HousingWire feature titled “US Housing Construction is Dead with Current Mortgage Rates” highlights how a steep rise in borrowing costs has roiled the single‑family home market, dented builder confidence, and left a new‑home inventory that is shrinking faster than demand can keep up. The article’s analysis is rooted in a blend of recent Census Bureau data, the National Association of Home Builders (NAHB) housing‑market index, and comments from industry insiders who warn that the construction slowdown could ripple into broader economic woes.

1. Mortgage Rates and Their Immediate Impact

The piece opens by pointing out that the median 30‑year fixed‑rate mortgage has been hovering in the 7‑plus‑percent range for several months, far above the roughly 4‑percent average seen during the early‑2020s boom. That jump, the article notes, is largely a reaction to the Federal Reserve’s aggressive rate hikes aimed at curbing inflation. A link in the article directs readers to the Federal Reserve’s official policy rate history, which confirms that the “Fed funds” rate is currently 5.25–5.50 %, a sharp contrast to the near‑zero levels of 2020.

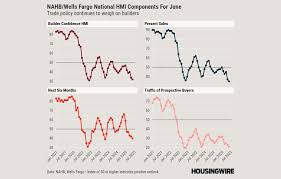

With borrowing costs that high, many potential homebuyers have been priced out of the market. HousingWire cites a recent NAHB “Housing Market Index” that fell to its lowest level in 13 years, indicating a severe drop in buyers’ confidence. The article stresses that the impact is most pronounced for first‑time buyers, who traditionally rely on affordable mortgage rates to enter the market.

2. New‑Home Sales and Permits Take a Tumble

One of the article’s most compelling pieces of evidence comes from the Census Bureau’s monthly new‑home sales data. According to the HousingWire piece, May 2023 saw new‑home sales slide 6.8 % year‑over‑year, reaching a 20‑year low. The article explains that the decline isn’t merely a statistical blip; it signals a fundamental shift in the demand–supply balance.

The construction side of the equation has not fared better. HousingWire highlights a 9.4 % drop in single‑family building permits in May, the steepest decline in nearly a decade. Multi‑family permits have fallen as well, though at a slower rate, because larger developments often have more financial cushion. A link embedded in the article to the Census Bureau’s building‑permits dashboard offers readers an interactive view of the trend over the past 12 months.

3. Builder Confidence and the Human Factor

Beyond the hard data, the HousingWire article features several interviews with developers and architects. One prominent voice, a senior vice president at a mid‑size builder in Texas, lamented that “if rates stay this high, we’re going to have to cancel projects before they even get off the ground.” He points out that construction projects are long‑term commitments, and a sudden increase in financing costs can render a project financially unviable mid‑build.

Another expert from the NAHB emphasizes that builder confidence has slipped below the 50‑point threshold—normally considered the “no‑confidence” line on the housing‑market index—for the first time in more than a decade. The article argues that the fear of a “rate‑induced recession” could lead builders to adopt a “wait‑and‑see” approach, stalling projects even when they might otherwise be profitable.

4. Secondary Effects: Labor and Supply Chains

The HousingWire feature doesn’t stop at construction numbers; it also delves into the secondary impacts on labor and supply chains. A section of the article linked to the U.S. Bureau of Labor Statistics (BLS) shows that construction employment fell 4.5 % from the peak of 2021, a decline that threatens the broader economy. The article suggests that a slowdown in homebuilding can translate into reduced demand for lumber, steel, and other building materials, tightening supply and pushing prices up—further discouraging new construction.

5. Policy Options and a Call to Action

In its closing section, the article calls for a nuanced policy response. HousingWire quotes an economist who argues that “the Fed’s current tightening stance may be too aggressive for the housing market.” The author points to a recent Fed research paper (link provided) that discusses how monetary policy can be tailored to avoid a construction downturn. HousingWire also urges local governments to consider targeted tax incentives or streamlined permitting processes to cushion the blow for builders.

Key Takeaways

- Mortgage rates hovering above 7 % are making homeownership prohibitively expensive for many potential buyers.

- New‑home sales and building permits have hit 20‑year lows, with single‑family permits down nearly 10 % year‑over‑year.

- Builder confidence has fallen below the NAHB’s critical 50‑point threshold, prompting many developers to pause or cancel projects.

- Construction employment is shrinking, and supply‑chain disruptions are exacerbating costs for both builders and consumers.

- Policy interventions—including potential adjustments to Fed rates, tax incentives, and streamlined permitting—may be necessary to avert a broader economic slowdown.

By weaving together official statistics, industry testimony, and policy analysis, the HousingWire article paints a sobering picture of a construction sector on the brink. Whether the market will recover or if we will enter a prolonged phase of stunted growth depends largely on how monetary policy evolves and how quickly builders can adapt to a high‑rate environment. As the article concludes, “the construction of a house is more than bricks and timber; it’s a bellwether for the health of the entire economy.”

Read the Full HousingWire Article at:

[ https://www.housingwire.com/articles/us-housing-construction-is-dead-with-current-mortgage-rates/ ]