Trump Restricts Institutional Home Buying

East Bay Times

East Bay TimesLocales: Washington, California, UNITED STATES

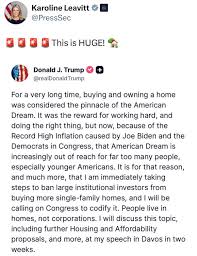

WASHINGTON - President Donald Trump yesterday signed an executive order initiating significant restrictions on institutional investors' ability to purchase existing single-family homes. The move, lauded by housing advocates and some real estate professionals, aims to address growing concerns that large-scale investment in the housing market is exacerbating affordability issues and hindering homeownership opportunities for individual Americans. The date was February 11th, 2026, although the order was signed on February 11th, 2026, the effects are rippling through the market today.

The executive order specifically targets hedge funds, private equity firms, and other large institutional investors who have dramatically increased their presence in the single-family housing market over the past decade. While not a complete ban, the order directs relevant federal agencies to draft regulations within the next 180 days that would limit the purchase of existing homes by these entities. Importantly, investment in new construction remains unaffected, signaling an intent to not stifle housing development but rather to reshape the market dynamics of resale properties.

Speaking from the Oval Office, President Trump framed the order as a direct response to the "squeezing out" of American families by deep-pocketed investors. He argued that the current market conditions are unsustainable and that the order is a necessary step to "protect American families" and ensure they have a fair chance at achieving the dream of homeownership. The President's statements follow years of mounting pressure from local governments, housing rights organizations, and increasingly frustrated potential homebuyers who have struggled to compete with all-cash offers and rapid bidding wars fueled by institutional buying.

The practice of institutional investment in single-family homes has become increasingly prevalent since the 2008 financial crisis. Initially driven by the demand for rental properties following foreclosures, these firms began acquiring homes in bulk, often renovating them, and then either renting them out or "flipping" them for a profit. While proponents of this model argue that it provides much-needed rental housing stock and can help stabilize neighborhoods, critics claim it artificially inflates home prices, reduces the availability of homes for owner-occupants, and contributes to wealth inequality. Data from various housing market analysis firms shows a substantial increase in the percentage of homes purchased by institutional investors in many major metropolitan areas, further fueling the debate.

Sarah Miller, a senior analyst at the Center for Housing Policy, described the order as a "big moment" with potentially significant ramifications. "The impact is still unclear, but the administration is clearly signaling its priority: to address housing affordability and promote homeownership," she stated. "The devil will be in the details of the regulations, but this order could fundamentally alter the landscape of the housing market." Miller emphasized that the regulations need to be carefully crafted to avoid unintended consequences, such as discouraging overall investment in the housing sector.

The National Association of Realtors (NAR) released a statement praising the order, calling it a positive step towards "leveling the playing field" for individual homebuyers. They believe that reducing the competitive pressure from institutional investors will allow more families to successfully navigate the home-buying process. However, the Securities Industry and Financial Markets Association (SIFMA), a leading trade group representing investment firms, vehemently criticized the order, labeling it "unnecessary and disruptive." SIFMA argues that the order infringes upon property rights and will ultimately harm the housing market by reducing investment and liquidity.

Legal challenges are widely anticipated. Opponents of the order are likely to argue that it violates the Fifth Amendment's Takings Clause, which protects private property rights, and potentially the Equal Protection Clause if the regulations are deemed discriminatory. The legality of the order will likely be scrutinized in the courts, potentially leading to a protracted legal battle.

Beyond the legal challenges, the long-term effects of this order remain to be seen. Experts predict a potential decrease in the volume of homes purchased by institutional investors, potentially creating more opportunities for individual buyers. However, the order could also lead to a slowdown in renovation activity in some areas and could potentially impact rental rates. Furthermore, some analysts suggest that the order may simply shift investment towards other asset classes, such as multi-family housing or commercial real estate. The coming months will be crucial as federal agencies work to draft the regulations and the market adjusts to this unprecedented intervention in the housing landscape.

Read the Full East Bay Times Article at:

[ https://www.eastbaytimes.com/2026/01/21/trump-signs-order-targeting-institutional-housing-investors/ ]