REAG Act Bans Stock Trading for Congress Members

Locales: District of Columbia, Florida, UNITED STATES

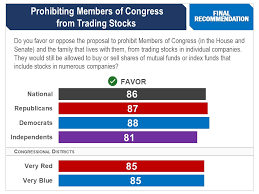

Washington, D.C. - The "Restoring Ethical Accountability in Government" (REAG) Act officially became law today, marking a watershed moment in the ongoing debate surrounding financial ethics in Congress. Signed by the President on Monday, February 9th, 2026, the bill effectively bans members of Congress, their spouses, and dependent children from trading individual stocks - a practice that has drawn increasing scrutiny and fueled public distrust in recent years. This isn't simply a new rule; it's the culmination of years of campaigning by ethics groups and a growing awareness among legislators that the appearance of conflicts of interest can be just as damaging as actual impropriety.

For years, concerns have swirled around the potential for lawmakers to exploit their positions for personal financial gain. Investigative journalism, spearheaded by outlets like the National Integrity Watchdog and detailed reports from the OCE, have uncovered instances of members trading stocks in companies directly impacted by legislation they were considering, or receiving preferential access to initial public offerings (IPOs). These revelations sparked public outrage and calls for stricter regulations. While technically legal in many cases previously, such actions eroded public confidence and created the perception of a self-serving political class.

The REAG Act addresses these concerns head-on with several key provisions. The most significant is the outright prohibition of individual stock trading for covered individuals. This aims to eliminate the most obvious avenue for potential conflicts of interest. While index funds and Exchange Traded Funds (ETFs) remain permissible, they are subject to enhanced reporting requirements - a nod to concerns that even passive investments can present ethical dilemmas. This tiered approach acknowledges the complexities of financial holdings while attempting to strike a balance between investor freedom and public trust.

The enhanced transparency measures are also crucial. The requirement for quarterly public disclosures, coupled with a real-time online database, will allow citizens and watchdogs to monitor lawmakers' financial activities with unprecedented access. Previously, disclosures were often delayed and difficult to navigate, hindering effective oversight. This new database, hosted by the Government Accountability Office, is expected to be user-friendly and searchable, making it easier to identify potential red flags. Furthermore, the database will incorporate an automated alert system that flags transactions involving companies lobbying Congress or directly affected by pending legislation.

However, the REAG Act isn't without its critics. Some argue that the legislation doesn't go far enough, advocating for a complete ban on all financial assets beyond standard retirement accounts. They point to the potential for conflicts of interest even within broader investment portfolios and argue that the most effective way to ensure ethical conduct is to remove the temptation altogether. Organizations like Common Cause have pledged to continue lobbying for a more comprehensive ban, believing that the current law represents a compromise rather than a definitive solution. They argue that a total ban would signal a stronger commitment to public service and definitively eliminate any perception of self-enrichment.

The Office of Congressional Ethics (OCE) will play a central role in enforcing the new law. The REAG Act significantly expands the OCE's authority and resources, allowing it to conduct more thorough investigations and pursue penalties for non-compliance. These penalties range from fines and censure to potential expulsion from Congress - demonstrating a serious commitment to accountability. The OCE is currently undergoing a period of staffing and training to prepare for the influx of cases anticipated following the law's implementation. They are also developing clear guidelines for interpreting the legislation and addressing complex financial scenarios.

The 90-day phase-in period is designed to provide lawmakers with a reasonable timeframe to divest their existing stock holdings. This is a crucial element of the bill, as a sudden and forced liquidation could have destabilizing effects on the market. However, some critics worry that the phase-in period provides a loophole for lawmakers to make strategic trades before the ban takes full effect. Close monitoring during this period will be essential to ensure compliance and prevent any attempts to circumvent the law.

The long-term impact of the REAG Act remains to be seen. While it represents a significant step towards restoring ethical accountability in government, its success will depend on rigorous enforcement, ongoing oversight, and a continued commitment to transparency. The law has already sparked conversations about extending similar restrictions to other government officials and addressing broader issues of campaign finance reform. This may very well be the beginning of a larger movement to rebuild public trust in government and ensure that elected officials are truly serving the interests of their constituents.

Read the Full Sun Sentinel Article at:

[ https://www.sun-sentinel.com/2026/01/15/congress-stock-trading-ban-bill/ ]