Mortgage Rates Plunge to Two-Year Lows

Fortune

FortuneLocale: Not Specified, UNITED STATES

Mortgage Rates Plunge to Two-Year Lows: Is This the Spring Housing Market Boost We've Been Waiting For? (February 9, 2026)

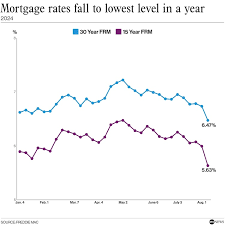

Mortgage rates have experienced a dramatic decline today, February 9th, 2026, hitting their lowest levels in over two years. This surprising downturn offers a potential shot in the arm for the sluggish housing market, providing relief to prospective homebuyers and opening doors for millions to refinance existing loans. After months of uncertainty and fluctuating rates, this drop is being hailed as a significant turning point.

The Root of the Rate Relief

The primary driver behind this encouraging trend is a sustained deceleration in inflation. Last week's economic data confirmed what many analysts had hoped for - a continued easing of price pressures across key sectors. This has led investors to dramatically revise their expectations regarding the future path of Federal Reserve monetary policy. The Federal Reserve, signaling a potential pause and even a possible reversal of its aggressive interest rate hiking campaign over the past two years, has ignited a surge in the bond market. Bond yields and mortgage rates are inversely related; as bond yields fall, mortgage rates typically follow suit.

Current Rate Landscape (February 9, 2026)

Here's a snapshot of the average rates currently available:

- 30-Year Fixed: 3.75% (down from 4.10% last month - a substantial 0.35% decrease)

- 15-Year Fixed: 3.05% (down from 3.35% last month)

- 5/1 Adjustable-Rate Mortgage (ARM): 3.20% (down from 3.50% last month)

Please note: These rates are based on a borrower profile with a strong credit score (760 FICO) and a 20% down payment. Individual rates will vary depending on creditworthiness, loan type, down payment amount, and other factors.

Beyond the Numbers: The Wider Economic Implications

The impact of these lower rates extends beyond individual borrowers. A more affordable mortgage market could inject much-needed stimulus into the housing sector, which has been struggling with affordability issues and declining sales volume. This could also have a ripple effect on related industries, such as construction, home furnishings, and real estate services.

"We're seeing a confluence of factors aligning to create this favorable environment," explains Sarah Chen, senior mortgage analyst at Financial Insights Group. "The cooling inflation, coupled with the Fed's more dovish stance, is restoring confidence in the market. The question now is whether this trend will be sustained." Chen further adds that the real estate market has been anticipating this for several months, and a drop in rates could unlock pent-up demand.

What Should Borrowers Do Now? A Strategic Guide

Experts overwhelmingly agree that borrowers should act decisively. While predicting the future is impossible, the prevailing sentiment is that these historically low rates are unlikely to persist indefinitely. Here's a breakdown of recommended actions:

- Refinance Opportunities: If you currently hold a mortgage with a rate significantly higher than 3.75%, a refinance could save you substantial money over the life of the loan. Even a small reduction in your interest rate can translate to significant monthly savings. Explore your options and compare offers from multiple lenders.

- First-Time Homebuyers: Lower rates dramatically increase your purchasing power. It allows you to afford a more expensive home for the same monthly payment or to keep your monthly payment lower on a home within your budget. Now is an excellent time to get pre-approved for a mortgage and begin your home search.

- Move-Up Buyers: For those looking to trade up to a larger or more desirable home, these rates can make the transition more affordable. Assess your financial situation and explore your options.

- Consider an ARM: While fixed-rate mortgages offer stability, a 5/1 ARM may provide an even lower initial interest rate, although it's important to understand the potential for rate adjustments after the initial fixed period.

The Road Ahead: Monitoring Key Indicators

The mortgage market remains highly sensitive to macroeconomic forces. In the coming weeks, pay close attention to the following:

- Inflation Reports: Further declines in inflation will likely reinforce the downward pressure on rates.

- Federal Reserve Communications: Monitor the Fed's statements and press conferences for clues about its future policy intentions.

- Employment Data: A weakening labor market could also lead the Fed to adopt a more accommodative monetary policy.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor and mortgage professional before making any decisions related to your personal finances or mortgage.

Read the Full Fortune Article at:

[ https://fortune.com/article/current-mortgage-rates-02-09-2026/ ]