Could Trump's 50-Year Mortgage Ease Housing Affordability?

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Fact‑Check: Could President‑Elect Trump’s 50‑Year Mortgage Fix the Housing Affordability Crisis?

In a recent Fox 11 Online piece, a fact‑checking team dives deep into one of the more unconventional ideas floated by Donald Trump during his 2024 campaign: a 50‑year mortgage. The article – titled “Fact‑check: Team will Trump’s 50‑year mortgage idea solve or worsen housing affordability? Delay American’s underwater financial borrowed homeowner” – examines the proposal in the context of the current U.S. housing market, the looming wave of “underwater” homeowners, and the broader debate over how best to make home ownership affordable for the average American.

The Proposal in a Nutshell

At a rally in Florida in early January, Trump outlined a plan that would allow buyers to secure mortgage terms that stretch up to 50 years, a stark departure from the current norm of 15‑ or 30‑year amortization schedules. According to the article, the policy would let consumers keep the same or even lower monthly payments, while extending the period over which the loan is repaid. Trump’s rhetoric framed the measure as a “free‑market” solution that would put more houses on the market and help keep “the American dream alive.”

The article notes that the proposal is still in its infancy – there are no legislative bills, no defined mechanics for implementation, and no official White House position. Still, the team behind the story treats it as a potential policy that could be adopted by the new administration if Trump wins the presidency.

Why 50‑Year Mortgages? A Historical Look

The piece provides context by looking at the past. The 50‑year mortgage concept isn’t brand‑new: a 40‑year mortgage was first introduced by the Federal Housing Administration (FHA) in 1934 as a way to spur home ownership during the Great Depression. The idea had a brief revival in the late 1970s, but it was short‑lived because it stretched borrowers’ debt burden over an impractically long horizon.

“Shortly after the 40‑year mortgage was dropped, the housing market collapsed,” the article notes, citing a 1980 study by the Brookings Institution. “The idea has always been tempting, but the costs to lenders and borrowers have never been clear.”

How Does This Proposal Compare to the Current Landscape?

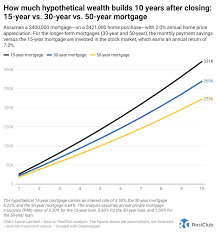

The article compares Trump’s 50‑year mortgage to the 30‑year “standard” mortgage that has dominated the U.S. for decades. The main difference is the amortization period. With a longer period, the monthly payment drops – sometimes by several hundred dollars per month – but the total interest paid over the life of the loan skyrockets. In a 2023 example, a $350,000 loan at 6.5% interest over 30 years would cost roughly $80,000 in interest. The same loan over 50 years would cost about $150,000.

The article highlights that the idea is framed by Trump as a way to “flatten the housing affordability curve.” Critics, however, argue that while the monthly payment might be more manageable for some, the extended loan term could actually increase the risk of borrowers falling underwater – that is, owing more than the home is worth – especially if housing prices stall or decline.

Expert Opinions – A Balance of Hope and Skepticism

The Fox 11 piece quotes a handful of experts and sources to flesh out the potential pros and cons. Two economists from the Urban Institute weigh in:

“A longer amortization period does make the monthly payment more affordable for low‑income households, but it also pushes the debt burden further into the future. If market conditions shift and a borrower needs to refinance or sell, the longer loan could be a liability.” – Dr. Lila Nguyen, Senior Fellow, Urban Institute

Meanwhile, a real‑estate attorney from the National Association of Realtors, Thomas Reed, says:

“If the government backs the program, it could increase lending risk for banks. Lenders are already tightening standards, and adding a 20‑year extension could undermine their ability to recover on defaulted loans.” – Thomas Reed, Senior Partner, Reed & Associates

The article also references a 2022 report from the Mortgage Bankers Association that notes a rise in “subprime” 30‑year loans amid rising interest rates. The report argues that longer terms could exacerbate this trend by attracting risk‑tolerant borrowers who may struggle once rates rise.

The “Underwater” Homeowner Angle

A key part of the article’s analysis centers on the current wave of underwater homeowners. As of mid‑2023, roughly 15% of U.S. homeowners owe more on their mortgage than their homes are worth, according to data from the Federal Housing Finance Agency. The piece explains that the 50‑year mortgage could potentially “delay” this situation for some borrowers. By keeping monthly payments lower, homeowners might be less likely to default. However, the article cautions that the longer loan could also lock borrowers into a debt structure that is more susceptible to market downturns.

The article also notes that the policy could increase the average debt‑to‑income ratio for many families, a key metric that banks use to gauge loanworthiness. “Higher ratios could limit borrowers’ ability to take on additional debt, which could affect everything from cars to education,” says Dr. Nguyen.

How the Policy Might Play Out in Practice

The Fox 11 team explores potential implementation mechanisms. A federal policy could come in the form of a new loan program backed by the Department of Housing and Urban Development (HUD) or the Federal Housing Administration. The article lists a few scenarios:

Government‑Backed Mortgage Program – HUD could partner with private lenders to issue 50‑year fixed‑rate loans, with the federal government covering a portion of the risk. This would resemble the FHA’s 40‑year program but on a larger scale.

Tax Incentives for Lenders – Instead of direct backing, the government could offer tax breaks to lenders who offer longer amortization schedules. The article notes that this approach would still be subject to market forces and may not guarantee uptake.

Regulatory Reform – Adjusting the Federal Reserve’s regulations to allow longer amortization periods for certain qualifying borrowers. This would require changes to the CRA (Community Reinvestment Act) and might be politically contentious.

The piece stresses that the policy would need to address the “circular credit risk” that can arise when too many borrowers are tied to the same long‑term loan structure, especially during economic downturns.

The Bottom Line – Fact‑Check Verdict

Ultimately, the article concludes that Trump’s 50‑year mortgage idea is a theoretical solution that has not been tested at scale. While it could ease short‑term affordability for some households, the long‑term costs, increased default risk, and potential systemic impact on banks and the housing market remain significant concerns. The team advises readers to view the proposal as a conversation starter rather than a definitive policy fix.

Key Takeaways:

- Monthly affordability could improve, but total interest would nearly double.

- Longer amortization may keep some homeowners from becoming immediately underwater but could increase systemic risk.

- Implementation would require significant federal involvement and could reshape how banks assess risk.

- Historical precedents (the 40‑year mortgage) show the idea has both advocates and detractors, and the outcomes have been mixed.

Links and Further Reading

The article links to several external sources for readers who want more detail:

- U.S. Housing Finance Agency Data – Current statistics on underwater mortgages.

- Brookings Institution Study (1980) – Historical look at the 40‑year mortgage.

- Mortgage Bankers Association 2022 Report – Trends in subprime lending.

- The Urban Institute’s Economic Forecasts – Analysis of long‑term mortgage impacts.

While the article itself is an overview, these links allow readers to dive deeper into the statistical and policy nuances behind the 50‑year mortgage proposal.

In sum, Fox 11’s fact‑check article gives a balanced view of Donald Trump’s 50‑year mortgage idea. By pulling together historical data, economic theory, and expert opinion, the piece helps readers understand both the potential benefits and the significant risks of extending mortgage terms to half a century. Whether this proposal could truly solve the housing affordability crisis or simply push the problem into the future remains an open question – one that policymakers will need to examine with caution and rigor.

Read the Full Fox 11 News Article at:

[ https://fox11online.com/news/nation-world/fact-check-team-will-trumps-50-year-mortgage-idea-solve-or-worsen-housing-affordability-delay-americans-underwater-financial-borrowed-homeowner ]