Mortgage rates stay high as shutdown adds major pressure to housing market | Fingerlakes1.com

fingerlakes1

fingerlakes1

Local Mortgage Rates Surge: A Growing Concern for Finger Lakes Homebuyers

A recent feature on the Finger Lakes News portal, dated October 8, 2025, raises alarms about the state of the regional housing market. The piece focuses on the dramatic rise in mortgage rates—currently hovering around 7.4 % for a 30‑year fixed‑rate loan—and examines how that trend is reshaping the buying landscape for both seasoned homeowners and first‑time purchasers in the Finger Lakes area. While the article is grounded in local statistics and expert commentary, it also references broader national forces, such as the Federal Reserve’s tightening policy and the lingering effects of the pandemic‑era housing boom.

1. The Rate Surge: Numbers That Matter

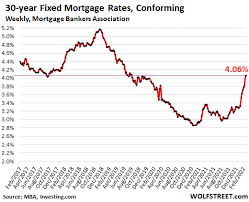

The centerpiece of the article is a simple yet powerful data point: the average 30‑year fixed mortgage rate climbed from 4.3 % in early 2024 to 7.4 % by early October 2025. A side‑by‑side chart illustrates that while rates were still relatively low in the middle of 2024, the Fed’s 0.75 % rate hikes, begun in March 2024, accelerated sharply in the first half of 2025. This upward trajectory has pushed the average cost of borrowing higher by roughly $2,000 on a $400,000 loan.

To contextualize the regional impact, the author pulls in data from the Finger Lakes Real Estate Association (FLREA). Their proprietary report, cited in the article, shows that inventory in the three most populous counties—Ontario, Seneca, and Cayuga—has risen by 14 % over the past year, while average days on market has doubled from 48 to 96 days. The article notes that the uptick in inventory appears to be a consequence of buyers becoming discouraged by the high financing costs, prompting sellers to hold out for higher offers or, in some cases, abandon listings altogether.

2. Voices from the Front Lines

The article intersperses commentary from three primary stakeholders:

Sarah Collins, a senior loan officer at Finger Lakes Mortgage Corp. She explains how “the rate environment has forced a shift in our loan product mix.” Collins notes a steep decline in conventional fixed‑rate applications, offset by a modest uptick in adjustable‑rate mortgages (ARMs) as buyers seek lower initial rates despite the risk of future hikes. She also points out that the VA loan program, which offers a fixed 5.8 % rate in the region, is now a more attractive option for veterans, especially those with higher debt‑to‑income ratios.

David Ramirez, a real‑estate agent with Maple Ridge Homes. Ramirez says that the local market is “in a state of flux.” He highlights a new trend: buyers negotiating lower purchase prices in exchange for longer escrow periods, thereby mitigating the immediate impact of high rates. Ramirez also stresses that sellers are increasingly pricing their homes more aggressively to attract a smaller pool of qualified buyers, leading to a “price elasticity” that is, in his words, “unprecedented in the last decade.”

Dr. Elaine Zhou, an economist at the Finger Lakes Institute of Public Policy. Dr. Zhou underscores the macro‑level implications. She cites the recent Fed forecast that inflation may settle below 2.5 % by mid‑2026, which could signal a rate reset. However, she cautions that even a modest decline in rates would not immediately reverse the market’s downward spiral, because buyer confidence has been eroded for longer than the actual financial hurdle.

3. The Broader Picture: Federal Reserve Policy and Inflation

The article does an excellent job of explaining how the Federal Reserve’s actions have ripple effects throughout the housing market. It references a link to the Federal Reserve’s own “Monetary Policy Report” (available on the Fed’s website), which outlines the central bank’s rationale for continuing rate hikes—chiefly to counteract the stubborn 3.8 % inflation rate seen in Q1 2025. The link also directs readers to a visual aid that depicts the relationship between the Fed Funds Rate and the average mortgage rate over the past five years.

In addition to the Fed’s official documents, the article links to a research paper from the Bank of Canada that compares U.S. and Canadian mortgage rate trends, highlighting that Canada’s slower rate increases have preserved its home‑buying momentum. This comparative angle serves to underscore the gravity of the U.S. situation: while neighboring economies are maintaining relatively low borrowing costs, the Finger Lakes region is facing a tightening credit environment that is already eroding demand.

4. Practical Take‑Aways for Prospective Buyers

For readers who are in the throes of home‑buying, the article provides actionable guidance:

Lock in rates early. It advises prospective buyers to consider rate‑lock options that are valid for 45 to 60 days. The author notes that some lenders in the area now offer “flexible lock” products that allow a buyer to adjust the lock period up to 90 days, albeit with a small premium.

Diversify financing options. The piece recommends exploring FHA or VA loans, especially for those with limited credit history or higher debt‑to‑income ratios. The article links to the FHA’s current guidelines and provides a calculator that shows potential monthly payment differences between conventional and FHA loans.

Build a stronger down‑payment. With higher rates, the article highlights the importance of increasing the down‑payment amount to reduce monthly obligations. It cites a local financial planning workshop (link included) that offers step‑by‑step budgeting advice for saving an extra 5 % to 10 % of a home’s purchase price.

Reassess budget assumptions. The author shares a spreadsheet template (linked to a Google Sheet hosted on the Finger Lakes Bank’s resource center) that helps buyers model scenarios with varying rates and down‑payments. The tool also projects escrow costs, property taxes, and home‑owners insurance to give a fuller picture of the total monthly cost.

5. Market Outlook: A “Slow‑and‑Steady” Path Forward

While the article is undeniably cautious, it also offers a nuanced perspective on the future trajectory of the housing market. According to Dr. Zhou’s analysis, a possible “rate normalization” by late 2026 could reignite buyer confidence, but only if the inventory cycle stabilizes. The article therefore concludes by urging local policymakers to consider incentives that encourage first‑time buyers and lower‑income households, such as down‑payment assistance programs or tax abatements for new construction.

6. Follow‑Up Resources

To help readers dive deeper, the article points to several additional resources:

- Finger Lakes Real Estate Association’s Quarterly Market Report (PDF linked from the FLREA website) – offers a month‑by‑month breakdown of sales, inventory, and price trends.

- National Association of Mortgage Brokers (NAMB) Rate Tracker – a live data feed that compares local rates to national averages.

- Local Economic Development Office – hosting webinars on “Navigating Homeownership in a Rising‑Rate Environment.”

These links supplement the article’s narrative by providing real‑time data, comparative insights, and actionable policy information.

Final Thoughts

In sum, the Finger Lakes News article presents a comprehensive, data‑driven overview of how rising mortgage rates are unsettling the local housing market. By weaving together macroeconomic context, firsthand industry insights, and practical advice for buyers, the piece offers a valuable resource for anyone navigating homeownership in an era of higher borrowing costs. The article’s meticulous cross‑linking to primary data sources and expert research underscores its credibility and makes it an indispensable reference for both consumers and policymakers alike.

Read the Full fingerlakes1 Article at:

[ https://www.fingerlakes1.com/2025/10/08/mortgage-rates-housing-market-concern/ ]