Millennials Face Ongoing Financial Hurdles to Homeownership

Locales: California, UNITED STATES

The Lingering Shadow of Financial Constraints

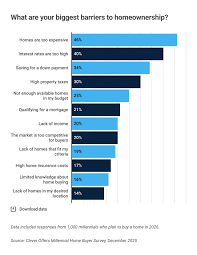

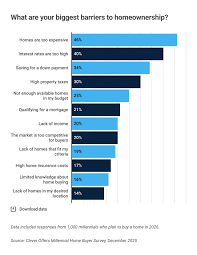

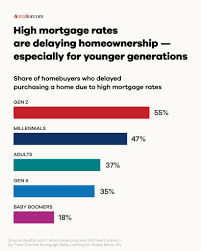

The financial landscape for millennials remains complex. The issues that initially deterred them from entering the housing market haven't entirely disappeared. Student loan debt continues to weigh heavily on many, with average balances still substantial despite some recent relief efforts. While wage growth has seen some improvement, it hasn't kept pace with the rapid escalation of housing prices in many metropolitan areas. Add to this the persistent impact of inflation, and the dream of homeownership can still feel financially daunting.

Lisa Walker, head of homeownership at Bank of America, emphasizes the ongoing affordability crisis. "The combination of high home prices, fluctuating but still elevated interest rates, and persistent inflation is creating a significant hurdle for millennials attempting to save for a down payment and qualify for a mortgage," she explains. Down payment requirements, even with assistance programs, often present the largest initial barrier. The lack of readily available, affordable housing stock in desirable locations further exacerbates the problem.

The Remote Work Revolution & Redefining Priorities

However, the narrative isn't solely one of financial struggle. Several key factors are contributing to this renewed interest in homeownership. Perhaps the most significant is the widespread adoption of remote work. The COVID-19 pandemic irrevocably altered work patterns, and while some companies are attempting to return to pre-pandemic norms, remote and hybrid work models are here to stay. This newfound flexibility allows millennials to relocate to more affordable areas, often outside of major urban centers, without sacrificing career opportunities.

This geographic flexibility has coincided with a broader reevaluation of priorities. Millennials, often characterized as prioritizing experiences over possessions, are increasingly recognizing the long-term financial benefits of homeownership. Owning a home isn't just about having a roof over one's head; it's viewed as a valuable asset, a potential source of wealth accumulation, and a stable investment for the future. The volatility of the stock market and other investment vehicles has further fueled this desire for tangible assets.

Innovative Approaches to Homeownership

Millennials aren't simply waiting for ideal conditions to materialize; they're actively seeking solutions and exploring alternative pathways to homeownership. Saving diligently for a down payment remains a primary focus, but many are also proactively researching various mortgage options, including those with lower down payment requirements or government assistance programs.

Furthermore, a growing number are embracing innovative homeownership models. Co-buying, where multiple individuals jointly purchase a property, is gaining traction as a way to share the financial burden and responsibilities. The tiny home movement, offering a smaller, more affordable footprint, is also resonating with millennials seeking minimalist lifestyles and reduced financial commitments. The rise of fractional ownership, allowing individuals to purchase a share of a property, is another emerging trend.

"Millennials are demonstrating remarkable resourcefulness and ingenuity," Walker notes. "They're actively challenging traditional norms and finding creative ways to overcome the obstacles and achieve their homeownership goals. They're not afraid to explore non-traditional options and are leveraging technology and community networks to make it happen."

Looking Ahead: The Future of Millennial Homeownership

While the path to homeownership for millennials remains challenging, the increasing interest and proactive approach suggest a potential shift in the market. The key to unlocking wider access will likely lie in addressing the affordability crisis through policies that promote increased housing supply, innovative financing options, and continued support for first-time homebuyers. The confluence of remote work, evolving priorities, and a generation determined to achieve financial stability points toward a future where millennials play an increasingly significant role in shaping the American Dream--and owning a piece of it.

Read the Full The Independent US Article at:

[ https://www.aol.com/news/millennials-giving-thought-ever-buying-033449746.html ]