Decoding Pre-Approval: More Than Just a Number

Local 12 WKRC Cincinnati

Local 12 WKRC CincinnatiLocale: Not Specified, UNITED STATES

The Pre-Approval Paradox: Why It's More Than Just a Number

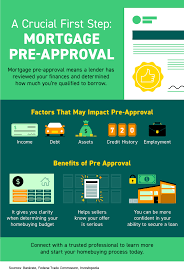

The article rightly points out that obtaining pre-approval is the crucial first step. However, it's not simply about getting pre-approved; it's about understanding what that pre-approval actually means. Many first-time buyers mistake pre-qualification for pre-approval. Pre-qualification is a preliminary assessment based on self-reported financial information. Pre-approval, conversely, involves a thorough review of your credit history, income, and assets by a lender, providing a much more reliable indication of your borrowing power. Getting a pre-approval letter strengthens your offer, demonstrating to sellers you're a serious and financially stable buyer. Furthermore, explore different loan options - conventional, FHA, VA - to find the best fit for your financial situation.

The Home Inspection: Beyond Identifying Obvious Flaws

Skipping the home inspection, particularly in a competitive market, is a gamble with potentially devastating consequences. While a fresh coat of paint and updated appliances can be alluring, they mask underlying issues like structural damage, faulty wiring, or plumbing problems. A qualified home inspector can identify these hidden defects, giving you negotiating leverage or, in severe cases, the ability to walk away from a problematic property. Consider specialized inspections beyond the general one - for example, a pest inspection, radon testing, or a sewer line camera inspection - depending on the property's location and age. Remember to attend the inspection yourself to ask questions and gain a first-hand understanding of the property's condition.

Decoding Closing Costs: Unearthing Hidden Expenses

The article correctly highlights the importance of factoring in closing costs. But it's crucial to understand the breadth of these costs. Beyond appraisal and title insurance, expect to pay for lender fees, recording fees, transfer taxes, and potentially points (a percentage of the loan amount paid upfront to lower the interest rate). Request a Loan Estimate from multiple lenders to compare fees and understand the complete picture. Don't be afraid to negotiate these fees, particularly with competitive lenders vying for your business.

Affordability Beyond the Monthly Payment: The Long Game of Homeownership

Many buyers focus solely on the monthly mortgage payment, failing to account for the total cost of ownership. Property taxes, homeowners insurance, potential HOA fees, and the inevitable costs of maintenance and repairs can significantly impact your monthly budget. Conduct a thorough analysis of your monthly income and expenses to determine a comfortable housing budget. Factor in a buffer for unexpected repairs - a general rule of thumb is to budget 1-3% of the home's value annually for maintenance. Consider how major life changes, such as a job loss or the arrival of a child, might affect your ability to afford the home.

Market Mastery and the Power of a Local Agent

Understanding the local market is paramount. Is it a buyer's, seller's, or balanced market? What are the average days on market? What is the typical price per square foot? This information will help you make informed offers. A knowledgeable real estate agent is invaluable in this process. Look for an agent with a proven track record in the specific area you're interested in. They can provide insights into neighborhood trends, school districts, and potential future developments.

Emotional Detachment: The Key to Rational Decision-Making

It's easy to fall in love with a house, but allowing emotions to cloud your judgment can lead to overpaying or overlooking red flags. Approach each property with a critical eye, focusing on its strengths and weaknesses. Be prepared to walk away if the price doesn't align with the property's value or if you have concerns about its condition.

Ongoing Costs: The Reality of Homeownership

Homeownership isn't a one-time expense. Ongoing maintenance is vital to preserve the value of your investment. Regular upkeep, like cleaning gutters, servicing the HVAC system, and addressing minor repairs, can prevent larger, more expensive problems down the road. Factor these costs into your long-term financial plan.

Empower Yourself Through Inquiry

Never hesitate to ask questions. No question is too small or silly. Your real estate agent, lender, and home inspector are resources available to guide you through the process. A well-informed buyer is an empowered buyer, capable of making sound financial decisions.

Read the Full Local 12 WKRC Cincinnati Article at:

[ https://local12.com/money/mortgages/first-time-homebuyer-mistakes ]