Trump Unveils Ambitious 'New Home' Plan for U.S. Housing Market

Newsweek

NewsweekLocales: Florida, New Jersey, New York, UNITED STATES

Wednesday, February 11th, 2026 - Former President Donald Trump has laid out an ambitious plan to overhaul the U.S. housing market, a sector grappling with persistent affordability challenges and a limited supply of available homes. Dubbed the "New Home" plan and detailed on his campaign website, the proposal goes beyond simple fixes, aiming for systemic change through a combination of tax incentives, deregulation, supply-side boosts, and - controversially - restrictions on foreign investment.

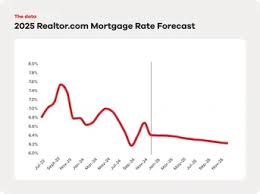

For years, the American dream of homeownership has become increasingly elusive for many. Rising interest rates, escalating construction costs, and a severe shortage of housing units have created a perfect storm, pushing prices beyond the reach of a growing segment of the population. Trump's plan directly addresses these issues, albeit with approaches that are already sparking debate among economists and housing market analysts.

The Core Tenets: A Multi-Pronged Approach

The plan rests on four key pillars. First, a substantial $25,000 tax credit for first-time homebuyers is proposed. This is a significant incentive, potentially lowering the initial financial hurdle for many aspiring homeowners. However, the effectiveness of such a credit hinges on overall market conditions. Some analysts argue that a tax credit, without addressing the underlying supply issue, could simply drive up prices as demand increases.

Secondly, Trump is advocating for a dramatic reduction in regulatory burdens impacting housing development. This includes streamlining permitting processes, easing zoning restrictions, and reducing compliance costs. The aim is to incentivize builders and developers, allowing them to bring new housing units to market more quickly and affordably. While deregulation is generally favored by the construction industry, critics warn that it could lead to compromises in building quality or environmental standards. The specifics of which regulations would be targeted remain somewhat vague.

Thirdly, the plan explicitly focuses on increasing housing supply. Beyond simply reducing red tape, it suggests incentives for building on previously unused or underutilized land. This could involve tax breaks for developers who choose to build on infill lots or brownfield sites, or even federal funding for infrastructure improvements to support new construction in underserved areas. Addressing the chronic shortage of housing is widely acknowledged as the most crucial step towards improving affordability, but it requires significant investment and long-term commitment.

The fourth, and perhaps most contentious, component is the restriction of foreign investment in U.S. real estate. Trump's plan proposes requiring all foreign investors to obtain approval from the Committee on Foreign Investment in the United States (CFIUS) before purchasing any U.S. residential property. The rationale is that foreign buyers, often unconcerned with long-term community ties, contribute to inflated prices and limit access to housing for American citizens. This aspect of the plan has drawn sharp criticism, with opponents arguing that it could stifle foreign capital inflows and harm economic growth.

Diving Deeper into the Foreign Investment Debate

The claim that foreign investment significantly drives up housing prices is a complex one. While anecdotal evidence suggests that cash-rich foreign buyers can outbid domestic purchasers in certain markets, the overall impact is debated. Proponents of restricting foreign investment point to concerns about money laundering and the use of U.S. real estate as a safe haven for illicit funds. They also argue that it creates an uneven playing field for American homebuyers. However, opponents emphasize the benefits of foreign investment, including job creation, economic stimulus, and increased property tax revenue. They warn that overly restrictive measures could discourage foreign investment altogether, leading to a decline in construction and a slowdown in the housing market.

Furthermore, there's the question of enforceability. Effectively tracking and regulating foreign investment in real estate is notoriously difficult, requiring robust data collection and international cooperation. The logistical challenges of implementing such a system could be substantial.

Expert Reactions and Potential Outcomes

The response to Trump's housing plan has been predictably polarized. Many conservative and pro-business groups have applauded the deregulation proposals and the focus on increasing housing supply. However, progressive organizations and housing advocates have expressed concerns about the potential for deregulation to exacerbate existing inequalities and the impact of restricting foreign investment. Economists are offering a range of predictions, from optimistic scenarios of increased affordability and construction to more pessimistic forecasts of market disruption and unintended consequences. The full plan is available for review at [ https://trump.gives/housing/ ].

Whether Trump's "New Home" plan represents a viable solution to the U.S. housing crisis remains to be seen. Its success will depend on a complex interplay of factors, including the political climate, economic conditions, and the ability to navigate the inherent trade-offs between competing interests. This remains a developing story, and its implications will undoubtedly be felt across the nation's housing landscape.

Read the Full Newsweek Article at:

[ https://www.newsweek.com/what-is-trump-home-new-plan-helping-housing-market-11461643 ]