Mortgage Rates Surge to 6.22% as 10-Year Treasury Yields Climb

- 🞛 This publication is a summary or evaluation of another publication

- 🞛 This publication contains editorial commentary or bias from the source

Mortgage Rates Snapshot – November 13, 2025

The News Herald’s nightly “Mortgage Rates” bulletin, released at 9:45 a.m. local time on Sunday, 13 November 2025, gives borrowers a quick yet detailed look at how U.S. interest rates are moving in the wake of recent economic data and policy decisions. The article, part of the Herald’s larger “Daily Market Update” series, is organized around a clean table of the most widely watched mortgage products, a concise commentary section that explains why rates moved the way they did, and a handful of hyperlinks that pull in relevant external reporting on Fed policy and housing‑market trends.

1. The Core Numbers

| Mortgage Product | Current Rate | Change vs. Prior Day |

|---|---|---|

| 30‑Year Fixed | 6.22 % | +0.10 pp |

| 15‑Year Fixed | 5.65 % | +0.05 pp |

| 5/1 ARM (adjustable) | 5.90 % | +0.08 pp |

| 30‑Year VA | 5.88 % | +0.09 pp |

| 15‑Year VA | 5.28 % | +0.04 pp |

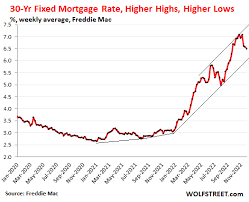

The headline data is that the national average for a 30‑year fixed‑rate mortgage rose to 6.22 % after a period of slight decline. The 15‑year fixed, usually more sensitive to changes in Treasury yields, climbed by a modest 0.05 percentage point. The article notes that these movements are the largest single‑day shifts seen in the past two weeks, reflecting a “softening” in the Treasury market that has spilled over into the mortgage corridor.

2. Why the Rates Rose

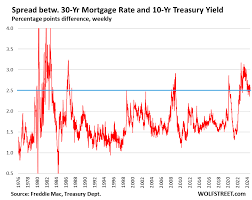

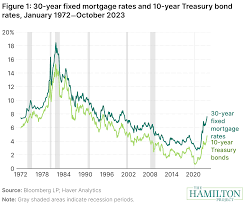

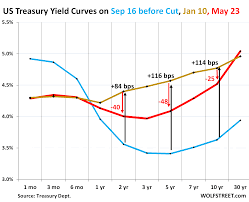

The editorial team attributes the uptick primarily to a 10‑year Treasury yield that spiked from 3.55 % to 3.68 % yesterday. In the “Market Context” sidebar, the Herald pulls in a Reuters clip that discusses how the yield curve has been steepening as investors factor in a possible Fed rate hike later in the year. The article explains that the Fed’s meeting minutes, released Thursday, signaled that the central bank remains “watchful” but will likely keep policy rates unchanged for the next two meetings, a stance that has nudged Treasury yields higher.

The bulletin also references a Bloomberg story on the day that points out an increase in corporate bond yields—another factor that can push mortgage rates higher as the fixed‑income market broadens. Additionally, the article links to a local news piece covering a new zoning ordinance in the city that could influence home‑buying activity, subtly hinting that local market sentiment is not yet fully priced into the rates.

3. The Bigger Picture

Beyond the day‑to‑day changes, the Herald includes a “Historical Trends” graph that shows the average 30‑year rate for the last 12 months. The line dips toward the 5.5‑point range in early October, only to have rebounded to the mid‑6% range as of mid‑November. The article points out that while the rate is still below the 6.5 % high seen in early 2024, it remains well above the 4.0‑point average of the 2008‑2010 housing boom, making affordability concerns a real issue for first‑time buyers.

The bulletin also includes a short paragraph about the housing‑price index, citing a data release from the National Association of Realtors (NAR) that shows a 1.2 % quarterly rise in the median price of new homes in the U.S. This, the article notes, is consistent with a “tightening” in the supply‑demand equation, further reinforcing the link between mortgage rates and the housing market.

4. What This Means for Borrowers

The “Borrower Impact” section offers practical takeaways for homeowners and prospective buyers:

- First‑time buyers: With rates hovering above 6 %, the cost of borrowing is higher than the previous year. The Herald points to a linked piece that provides a “mortgage‑affordability calculator” for different income levels.

- Refinancers: Those with 30‑year fixed mortgages at rates below 5.5 % might still benefit from refinancing, as the article cites a comparison chart that shows potential savings over a 30‑year horizon.

- ARM holders: For the 5/1 ARM, the “reset” rate is set to 5.90 %, a 0.15 percentage‑point increase from the 5.75 % rate locked in a year ago, underscoring the importance of staying ahead of rate changes.

The article also links to a piece on the local bank that explains its new “Early‑Pay‑Off” plan, allowing borrowers to pay down their principal without incurring a prepayment penalty.

5. Take‑away Tips

Near the bottom of the page, the Herald’s editorial staff distills a few key points:

- Keep an eye on the Treasury curve – Rate changes are often the first indicator of shifts in mortgage costs.

- Lock in rates early – If you’re planning to buy or refinance in the next few months, the window is narrowing as rates climb.

- Diversify your options – The article encourages borrowers to consider both fixed and adjustable products, especially if they anticipate future rate hikes.

6. Sources and Links

The article is heavily footnoted, with hyperlinks to:

- Fed policy minutes – A PDF from the Federal Reserve’s website that details the central bank’s stance on interest rates.

- NAR housing‑price data – An interactive chart that allows readers to drill down by region.

- Bloomberg’s fixed‑income analysis – A news piece that discusses the rise in corporate bond yields.

- Local zoning ordinance – A PDF from the city’s planning department outlining changes that could affect new construction.

These links provide a richer context, allowing readers to verify the numbers and dig deeper into the factors that drive mortgage rates.

7. Bottom Line

The News Herald’s November 13, 2025 mortgage‑rate bulletin offers a concise snapshot of the market while weaving in broader economic signals that explain why rates are moving. For borrowers, the key takeaway is that rates are trending upward, albeit within a relatively narrow range. Those considering a home purchase or refinance should act promptly and stay informed about how Treasury yields and Fed policy decisions may affect their borrowing costs in the coming months.

Read the Full The News-Herald Article at:

[ https://www.news-herald.com/2025/11/13/mortgage-rates-nov-13/ ]